Contactless cards: what they are and how to use them in loyalty programs

Contactless payment is much faster, more convenient and safer than standard transactions, due to which it has become widely used in retail. How it functions in practice and what it has to do with loyalty programs, read in our article.

What is a contactless smart card and how does it differ from a contact card?

Contactless plastic card , aka RFID card , is a type of electronic identifiers. It stores confidential data in its memory: passwords, digital certificates, user profiles and access keys, which are necessary for user authorization when making transactions. Unlike contact cards, an RFID card uses radio frequency identification technology to transmit information.

This means that it is always in the hands of the owner, so fraudsters have no chance to obtain the data for use in illegal transactions. Plus, during contactless payment, transaction data is protected by a dynamic code — a cryptogram that cannot be used for fraudulent purposes. This makes the use of RFID cards more secure compared to contact counterparts.

The principle of operation of contactless cards

Contactless RFID cards are extremely easy to use and do not require any special skills from the cashier or the user. It is enough to bring the card, smartphone or other gadget to the terminal - and that's it, the payment is complete.

At the technical level, of course, everything is a little more complicated. Here's what happens after the cardholder brings the device to the terminal:

- The card's microprocessor starts a payment application that generates a cryptogram - one-time keys for payment.

- An RFID signal is received at the terminal, which transmits the CVV code, the data of the card and its owner.

- The received information is sent to the bank.

- After data authentication, the bank allows the transaction and sends a request to enter the PIN code.

- The specified amount is debited from the user's account, and the terminal issues a check.

In fact, contact and contactless cards work according to the principle, and the main difference between them is only in the method of transmission.

Advantages of contactless smart cards

Contactless cards have a number of advantages that make them attractive not only for users, but also for businesses. Let's consider the main ones:

- Convenience . To make purchases, the user does not have to carry plastic with him. Instead, the card can be added to an electronic wallet on a smartphone, and the gadget can be held up to the reading device.

- Speed of transactions . Contactless payment is almost instantaneous — almost 10 times faster than other types of payments, because it does not need to be inserted into a terminal or a magnetic strip passed through a reader. Plus, for small transactions, the user often doesn't need to enter a PIN.

- High level of security . Many contactless smart cards use cryptographic protocols to ensure secure data transmission. This helps reduce the risk of fraud and data theft.

- Multifunctionality . Contactless smart cards can be used not only to pay for goods and services, but also for many other purposes, for example, to organize an effective and convenient loyalty program. We will talk about this in more detail a little later.

- Durability . The card is contactless, and therefore there is no mechanical contact during transactions. Accordingly, it does not wear out, which significantly extends the service life.

- Financial efficiency . RFID cards do not necessarily have to be plastic. Increasingly, they are virtual payment instruments, which significantly reduces the company's emission costs.

The EfirCards system is an analogue of contactless smart cards

Discount cards are the basis of almost any loyalty program. But in conditions when all banking has moved online, and contactless cards and gadgets are increasingly used for payments at retail outlets, efficiency has noticeably decreased.

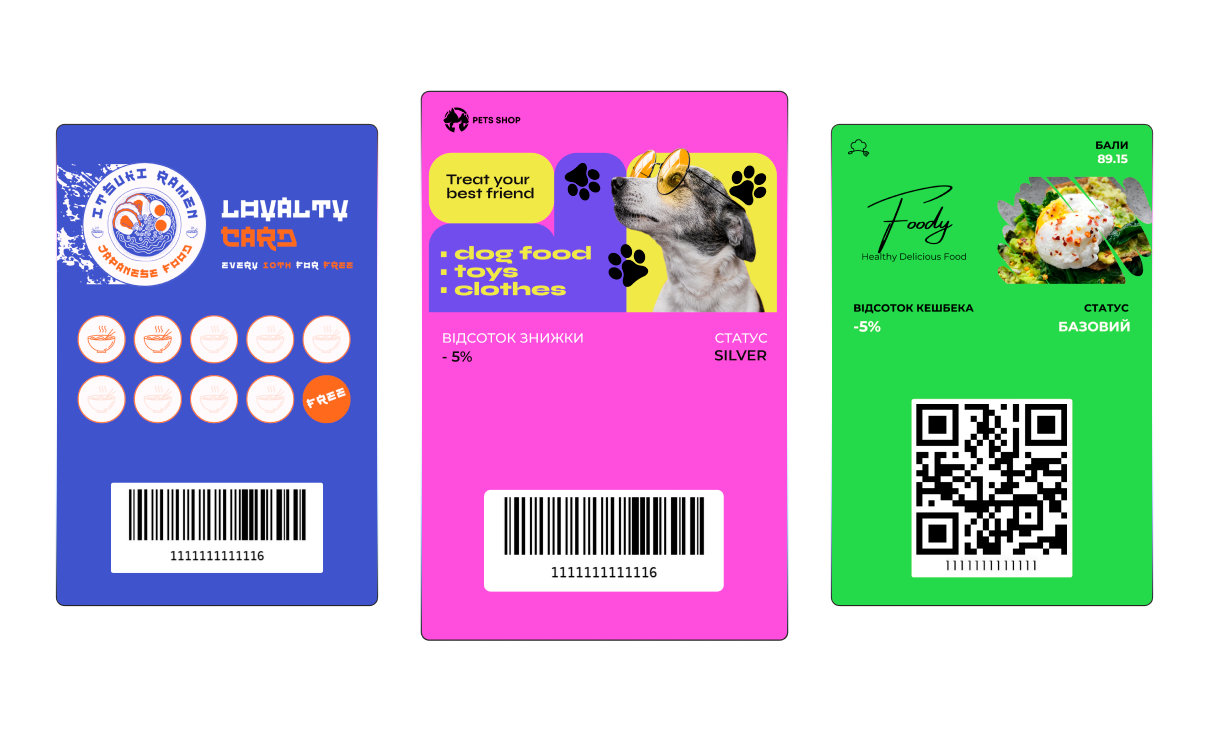

The EfirCards platform aims to solve this problem. It helps companies launch managed loyalty programs based on virtual discount cards, which in fact are an analogue of contactless bank cards. Users can add them to Google Pay or Apple Wallet and use them during transactions at points of sale to receive discounts, various points or accrue cashback.

How it works:

- You register your company on the Efir Cards platform, adjust the conditions of the loyalty program and create discount RFID cards with a unique design.

- Your customers can issue such a card in a few clicks with a QR code in their own smartphone.

- When paying at the cash register, the client selects your company's card in the electronic wallet and scans it at the terminal. Then the system automatically calculates bonuses, discounts and cashback, so cashiers do not have to spend time on this.

Why is EfirCards profitable?

The EfirCards platform provides companies with many advantages:

- Digitization of the customer base.

- Ability to issue an unlimited number of contactless discount cards.

- Flexible settings of loyalty programs.

- Tools for communication with the audience: via SMS, Telegram, Viber, e-mail, push and geo-push.

- Full automation of bonus calculation (when integrated with the checkout area).

- Current analytics in real time.

The EfirCards system is more than just virtual discount cards. It provides business with modern and convenient tools for interacting with the target audience and improving customer relations, which in turn contributes to increasing sales and increasing the company's competitiveness in the market.

How to start using EfirCards and how much does it cost?

Start using the advanced capabilities of EfirCards now, without any investment! To do this, register your company on our official website and get access to a temporary free subscription.